Explore ideas, tips guide and info Matti Melesa

Gift Annual Exclusion 2025. Regarding annual gifts, the current (2025) federal annual gift tax exclusion is $17,000.00 per u.s. The annual exclusion applies to gifts to each donee.

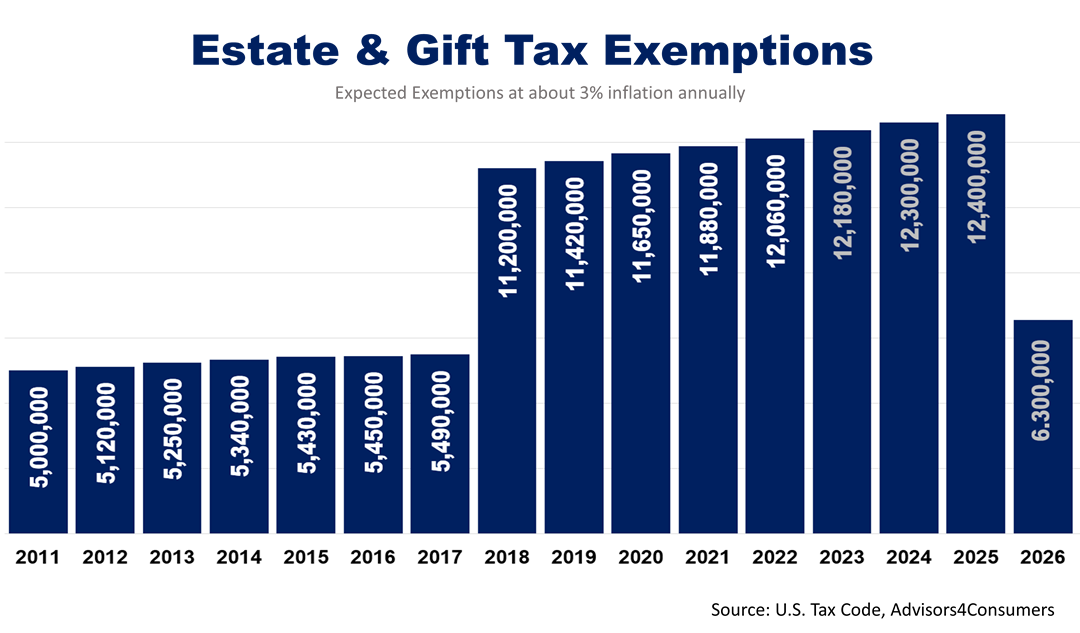

The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2025 due to inflation. Making large gifts now won’t harm estates after 2025.

The basic exclusion amount for determining the amount of the unified credit against estate tax under irc section 2010 will be $13,610,000 for decedents who die in 2025, a $690,000 increase from 2025.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, More like this tax strategy and planning taxes. For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts.

Annual Gift Tax Exclusion Amount Increases for 2025 News Post, With gift splitting, married couples will be able to gift up to $36,000 per recipient in 2025. The annual gift exclusion for 2025 is $17,000.

annual gift tax exclusion 2025 irs Trina Stack, Annual federal gift tax exclusion. In 2025, the annual gift tax exclusion amount will be $18,000 per recipient.

How Smart Are You About the Annual and Lifetime Gift Tax Exclusions, Sending a $20 bill with a. With gift splitting, married couples will be able to gift up to $36,000 per recipient in 2025.

Planning for YearEnd Gifts with the Gift Tax Annual Exclusion Roger, David and bill harlan john l. In other words, if you give each of your children $18,000 in 2025, the annual exclusion applies to each gift.

Hecht Group The Annual Gift Tax Exemption What You Need To Know, In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). Regarding annual gifts, the current (2025) federal annual gift tax exclusion is $17,000.00 per u.s.

IRS Increases Gift and Estate Tax Thresholds for 2025, This is the amount one can gift to a recipient during the year without filing a gift tax return and, therefore, without using any of their unified gift and estate tax exclusion. Scott real estate issaquah, wa.

Annual Gift Tax Exclusion A Complete Guide To Gifting, Making large gifts now won't harm estates after 2025. Sending a $20 bill with a.

Annual Gift Tax Exclusion Amount to Increase in 2025, For 2025, you can gift up to $18,000 to one person without. This means married couples will be able to gift up to $36,000 per year per recipient without causing a reduction of their combined.

The Retirement Coach The Retirement Coach℠ 2025 Estate & Gift Tax, Therefore, if a taxpayer has two children and three grandchildren, the taxpayer will be able to gift $18,000 to each of their five descendants ($90,000 total), without any gift tax consequence. This is a great way to help out a family member to get in a home today, especially if they're going to inherit it in the future anyway.